All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. mortgage protection life insurance plans brokers recommend. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

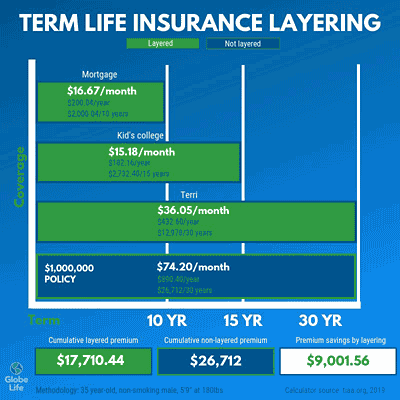

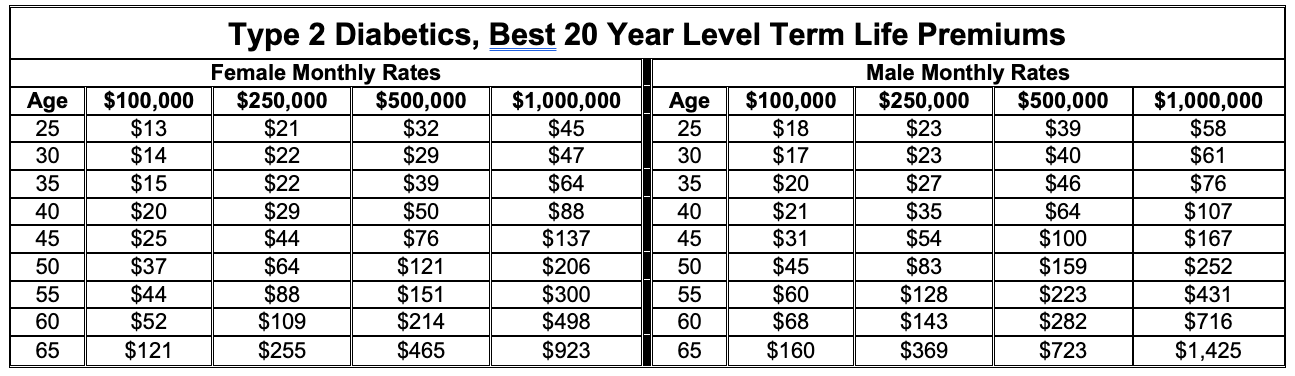

They normally offer an amount of insurance coverage for a lot less than long-term types of life insurance policy. Like any type of policy, term life insurance has advantages and downsides depending upon what will certainly work best for you. The benefits of term life consist of affordability and the ability to customize your term length and insurance coverage quantity based on your needs.

Depending on the kind of plan, term life can supply set costs for the whole term or life insurance policy on degree terms. The survivor benefit can be dealt with as well. Due to the fact that it's an affordable life insurance policy product and the settlements can remain the exact same, term life insurance policy policies are prominent with young people simply beginning, family members and people that want protection for a details amount of time.

Affordable Voluntary Term Life Insurance

You ought to consult your tax experts for your particular factual situation. Fees show plans in the Preferred And also Price Course issues by American General 5 Stars My agent was really knowledgeable and useful at the same time. No stress to get and the procedure was fast. July 13, 2023 5 Stars I was satisfied that all my demands were satisfied promptly and skillfully by all the reps I talked to.

All documentation was digitally finished with accessibility to downloading for personal file maintenance. June 19, 2023 The endorsements/testimonials presented need to not be understood as a suggestion to purchase, or an indicator of the value of any kind of service or product. The reviews are actual Corebridge Direct consumers that are not connected with Corebridge Direct and were not provided compensation.

2 Price of insurance coverage rates are determined making use of techniques that differ by company. It's essential to look at all elements when assessing the general competitiveness of rates and the worth of life insurance protection.

Best Term Life Insurance With Accidental Death Benefit

Like the majority of group insurance policies, insurance policy plans offered by MetLife contain certain exclusions, exemptions, waiting periods, decreases, restrictions and terms for keeping them in force (level premium term life insurance policies). Please contact your advantages administrator or MetLife for expenses and complete details.

Generally, there are 2 sorts of life insurance policy plans - either term or permanent strategies or some combination of both. Life insurance companies use different types of term strategies and conventional life policies along with "rate of interest delicate" items which have come to be more prevalent given that the 1980's.

Term insurance policy provides defense for a given amount of time. This duration could be as brief as one year or give protection for a certain number of years such as 5, 10, two decades or to a defined age such as 80 or in some situations up to the oldest age in the life insurance policy death tables.

Exceptional Short Term Life Insurance

Presently term insurance policy prices are extremely competitive and among the lowest historically skilled. It should be kept in mind that it is a commonly held belief that term insurance coverage is the least expensive pure life insurance policy coverage available. One requires to assess the policy terms meticulously to determine which term life options are appropriate to fulfill your specific scenarios.

With each new term the premium is boosted. The right to renew the policy without proof of insurability is an essential advantage to you. Otherwise, the threat you take is that your wellness may weaken and you may be incapable to acquire a plan at the exact same rates and even at all, leaving you and your recipients without coverage.

You need to exercise this alternative throughout the conversion period. The length of the conversion period will certainly differ depending on the sort of term policy bought. If you convert within the recommended duration, you are not required to give any kind of details regarding your health and wellness. The premium price you pay on conversion is usually based on your "present attained age", which is your age on the conversion day.

Under a degree term plan the face amount of the policy continues to be the very same for the whole duration. With reducing term the face amount reduces over the duration. The premium remains the very same annually. Often such policies are sold as home loan security with the quantity of insurance reducing as the balance of the home mortgage decreases.

Generally, insurance firms have not had the right to transform costs after the policy is sold (level term life insurance meaning). Given that such policies might proceed for several years, insurance providers need to use conservative mortality, interest and expenditure price estimates in the costs calculation. Flexible premium insurance coverage, nevertheless, allows insurance firms to supply insurance at lower "existing" costs based upon much less conservative assumptions with the right to alter these premiums in the future

Best Term Vs Universal Life Insurance

While term insurance is created to give protection for a defined amount of time, long-term insurance policy is made to provide insurance coverage for your entire lifetime. To keep the premium rate degree, the costs at the younger ages surpasses the actual expense of protection. This added premium constructs a book (cash money worth) which helps spend for the policy in later years as the cost of security surges over the premium.

The insurance coverage business spends the excess premium bucks This type of policy, which is sometimes called cash money value life insurance, creates a cost savings element. Cash values are critical to an irreversible life insurance coverage policy.

Term To 100 Life Insurance

Sometimes, there is no relationship between the dimension of the cash value and the premiums paid. It is the cash money value of the policy that can be accessed while the policyholder is alive. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the existing table utilized in determining minimal nonforfeiture worths and plan books for regular life insurance policy policies.

Several irreversible plans will consist of provisions, which specify these tax obligation demands. There are 2 fundamental classifications of long-term insurance, traditional and interest-sensitive, each with a number of variations. In enhancement, each group is normally available in either fixed-dollar or variable type. Traditional entire life policies are based upon long-term price quotes of cost, passion and death.

If these price quotes change in later years, the firm will readjust the costs as necessary but never over the optimum guaranteed premium specified in the policy. An economatic whole life plan gives for a fundamental quantity of getting involved whole life insurance coverage with an extra supplementary insurance coverage offered via making use of rewards.

Because the costs are paid over a much shorter span of time, the premium payments will be greater than under the entire life plan. Single premium whole life is limited payment life where one big exceptional settlement is made. The policy is fully compensated and no more costs are required.

Latest Posts

Final Expense Over The Phone

Funeral Insurance Us

Life Insurance Policy To Pay For Funeral