All Categories

Featured

Table of Contents

- – What is Life Insurance? Explained in Simple Te...

- – What is the Difference with What Is Direct Ter...

- – How Does Level Term Life Insurance Policy Kee...

- – What is Short Term Life Insurance? Key Points...

- – What is Life Insurance? Your Essential Quest...

- – What is Level Premium Term Life Insurance? E...

If George is detected with a terminal health problem during the first policy term, he probably will not be qualified to renew the policy when it runs out. Some policies supply assured re-insurability (without evidence of insurability), however such functions come at a greater expense. There are a number of kinds of term life insurance policy.

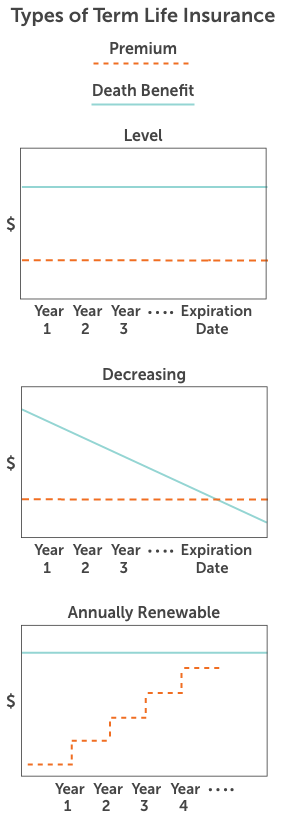

Most term life insurance coverage has a degree costs, and it's the type we've been referring to in most of this article.

Term life insurance policy is eye-catching to youths with youngsters. Moms and dads can obtain significant protection for a low price, and if the insured passes away while the plan is in result, the family can count on the death advantage to change lost revenue. These policies are likewise well-suited for people with expanding families.

What is Life Insurance? Explained in Simple Terms?

Term life policies are optimal for people who desire substantial protection at a reduced expense. People who possess entire life insurance coverage pay a lot more in costs for much less coverage but have the security of understanding they are protected for life.

The conversion motorcyclist should allow you to transform to any type of permanent policy the insurance provider offers without restrictions. The key features of the biker are maintaining the initial health score of the term policy upon conversion (even if you later have wellness issues or end up being uninsurable) and deciding when and just how much of the protection to transform.

Obviously, total costs will certainly increase dramatically because whole life insurance policy is a lot more expensive than term life insurance policy. The advantage is the ensured authorization without a medical examination. Clinical conditions that create during the term life duration can not trigger costs to be increased. However, the business might call for minimal or complete underwriting if you want to add additional motorcyclists to the new plan, such as a long-term care biker.

What is the Difference with What Is Direct Term Life Insurance?

Whole life insurance comes with significantly greater month-to-month premiums. It is suggested to provide coverage for as lengthy as you live.

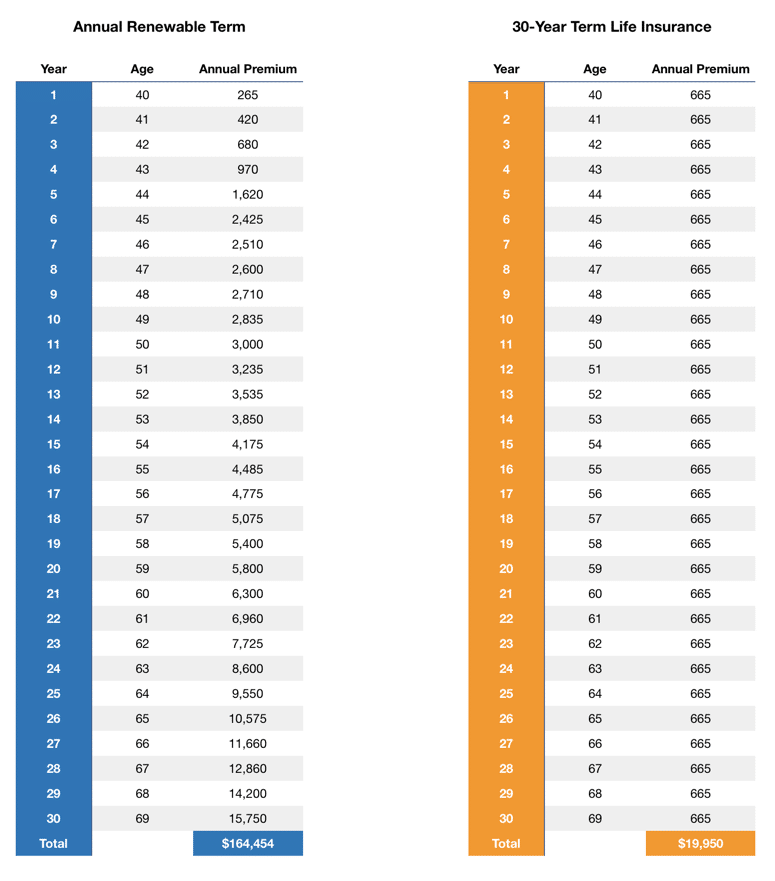

Insurance policy business set an optimum age restriction for term life insurance policy plans. The premium likewise rises with age, so a person matured 60 or 70 will pay considerably even more than someone years younger.

Term life is rather comparable to auto insurance policy. It's statistically not likely that you'll need it, and the costs are cash away if you do not. If the worst happens, your household will receive the benefits.

How Does Level Term Life Insurance Policy Keep You Protected?

Generally, there are two kinds of life insurance coverage plans - either term or irreversible strategies or some combination of both. Life insurance companies supply various types of term strategies and standard life plans along with "interest sensitive" products which have become much more widespread since the 1980's.

Term insurance coverage supplies protection for a specified duration of time. This duration can be as short as one year or supply protection for a particular number of years such as 5, 10, 20 years or to a defined age such as 80 or in some situations up to the oldest age in the life insurance policy death tables.

What is Short Term Life Insurance? Key Points to Consider?

Presently term insurance policy prices are really competitive and among the least expensive historically experienced. It needs to be noted that it is a commonly held belief that term insurance coverage is the least pricey pure life insurance policy protection readily available. One needs to examine the plan terms thoroughly to decide which term life options appropriate to fulfill your particular conditions.

With each new term the costs is enhanced. The right to restore the policy without proof of insurability is a crucial advantage to you. Otherwise, the danger you take is that your wellness may degrade and you might be incapable to get a policy at the very same prices or even in any way, leaving you and your recipients without protection.

The length of the conversion period will differ depending on the kind of term plan purchased. The premium rate you pay on conversion is generally based on your "existing attained age", which is your age on the conversion day.

Under a level term policy the face amount of the plan remains the very same for the whole duration. With reducing term the face amount decreases over the duration. The premium stays the exact same every year. Usually such policies are sold as home mortgage protection with the quantity of insurance decreasing as the balance of the home mortgage decreases.

Generally, insurers have not can change premiums after the plan is marketed. Since such policies may continue for years, insurance providers have to make use of conventional mortality, rate of interest and expenditure price price quotes in the costs computation. Flexible costs insurance coverage, nevertheless, enables insurers to use insurance at reduced "existing" costs based upon less conventional assumptions with the right to change these costs in the future.

What is Life Insurance? Your Essential Questions Answered?

While term insurance policy is made to offer defense for a specified period, irreversible insurance is developed to offer coverage for your entire life time. To maintain the premium rate level, the costs at the more youthful ages goes beyond the actual expense of security. This added costs develops a reserve (cash value) which assists spend for the policy in later years as the cost of defense rises over the costs.

Under some plans, costs are needed to be spent for a set variety of years (20-year level term life insurance). Under other policies, premiums are paid throughout the policyholder's life time. The insurance company spends the excess costs dollars This sort of plan, which is occasionally called cash worth life insurance policy, creates a cost savings element. Cash money values are critical to a long-term life insurance coverage policy.

In some cases, there is no correlation in between the dimension of the cash worth and the premiums paid. It is the cash money worth of the plan that can be accessed while the insurance policy holder is to life. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the present table used in computing minimal nonforfeiture worths and plan books for normal life insurance policy plans.

What is Level Premium Term Life Insurance? Explained in Detail

Several irreversible policies will certainly consist of provisions, which define these tax demands. Traditional whole life policies are based upon long-term estimates of cost, passion and death.

Table of Contents

- – What is Life Insurance? Explained in Simple Te...

- – What is the Difference with What Is Direct Ter...

- – How Does Level Term Life Insurance Policy Kee...

- – What is Short Term Life Insurance? Key Points...

- – What is Life Insurance? Your Essential Quest...

- – What is Level Premium Term Life Insurance? E...

Latest Posts

Final Expense Over The Phone

Funeral Insurance Us

Life Insurance Policy To Pay For Funeral

More

Latest Posts

Final Expense Over The Phone

Funeral Insurance Us

Life Insurance Policy To Pay For Funeral