All Categories

Featured

Table of Contents

Term plans are likewise usually level-premium, however the overage amount will stay the exact same and not expand. One of the most typical terms are 10, 15, 20, and thirty years, based on the requirements of the insurance policy holder. Level-premium insurance is a kind of life insurance in which premiums stay the exact same cost throughout the term, while the quantity of protection used increases.

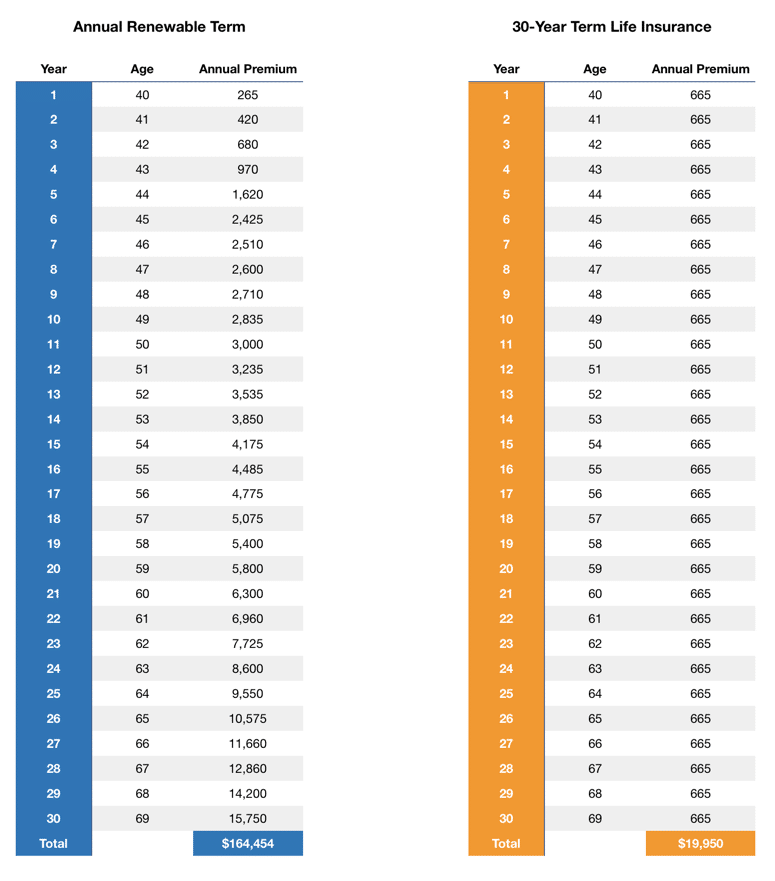

For a term policy, this suggests for the size of the term (e.g. 20 or three decades); and for an irreversible policy, up until the insured passes away. Level-premium plans will commonly cost more up-front than annually-renewing life insurance policies with terms of just one year at a time. However over the lengthy run, level-premium settlements are usually much more cost-efficient.

They each seek a 30-year term with $1 million in coverage. Jen gets an assured level-premium policy at around $42 each month, with a 30-year perspective, for an overall of $500 per year. Beth numbers she may just need a strategy for three-to-five years or up until complete payment of her existing financial debts.

So in year 1, she pays $240 each year, 1 and about $500 by year five. In years 2 through five, Jen proceeds to pay $500 monthly, and Beth has actually paid a standard of simply $357 annually for the same $1 numerous coverage. If Beth no much longer requires life insurance policy at year five, she will have conserved a whole lot of money about what Jen paid.

What Exactly is Term Life Insurance For Couples Policy?

Annually as Beth ages, she faces ever-higher yearly premiums. On the other hand, Jen will certainly remain to pay $500 annually. Life insurance firms are able to supply level-premium policies by essentially "over-charging" for the earlier years of the policy, accumulating even more than what is needed actuarially to cover the danger of the insured passing away throughout that very early duration.

Irreversible life insurance coverage establishes cash worth that can be borrowed. Plan fundings accumulate rate of interest and overdue policy car loans and passion will certainly minimize the fatality benefit and cash value of the plan. The amount of cash money value offered will normally rely on the sort of irreversible policy acquired, the amount of insurance coverage acquired, the length of time the policy has been in pressure and any type of outstanding policy car loans.

A full statement of coverage is discovered just in the policy. Insurance policy policies and/or connected cyclists and features might not be readily available in all states, and plan terms and conditions may vary by state.

Degree term life insurance is the most simple means to get life cover. Therefore, it's also the most popular. If the most awful occurs and you pass away, you recognize precisely what your enjoyed ones will receive. In this write-up, we'll explain what it is, how it functions and why degree term might be right for you.

What is Term Life Insurance For Couples? Your Guide to the Basics?

Term life insurance policy is a sort of plan that lasts a details length of time, called the term. You select the length of the policy term when you first get your life insurance policy. It might be 5 years, twenty years or perhaps more. If you die throughout the pre-selected term (and you've stayed on top of your costs), your insurance firm will pay out a round figure to your chosen beneficiaries.

Pick your term and your quantity of cover. Select the plan that's right for you., you know your premiums will certainly stay the very same throughout the term of the plan.

(Nonetheless, you don't get any money back) 97% of term life insurance coverage cases are paid by the insurer - ResourceLife insurance coverage covers most scenarios of fatality, but there will certainly be some exemptions in the regards to the plan. Exemptions may consist of: Genetic or pre-existing conditions that you stopped working to divulge at the begin of the policyAlcohol or medicine abuseDeath while committing a crimeAccidents while taking part in hazardous sportsSuicide (some plans omit fatality by self-destruction for the initial year of the plan) You can include important health problem cover to your level term life insurance policy for an extra price.Essential disease cover pays a section of your cover amount if you are identified with a major ailment such as cancer, heart strike or stroke.

After this, the plan ends and the surviving companion is no longer covered. People usually get joint plans if they have outstanding monetary commitments like a mortgage, or if they have children. Joint policies are usually a lot more inexpensive than single life insurance policy plans. Various other kinds of term life insurance policy policy are:Lowering term life insurance policy - The quantity of cover minimizes over the length of the plan.

What Makes Term Life Insurance With Level Premiums Different?

This safeguards the buying power of your cover amount versus inflationLife cover is a fantastic point to have due to the fact that it gives economic security for your dependents if the most awful occurs and you die. Your liked ones can likewise use your life insurance policy payout to pay for your funeral. Whatever they choose to do, it's wonderful comfort for you.

Level term cover is terrific for satisfying daily living costs such as home costs. You can additionally utilize your life insurance coverage benefit to cover your interest-only home loan, payment home mortgage, college charges or any kind of other debts or ongoing payments. On the various other hand, there are some drawbacks to level cover, compared to other kinds of life policy.

Term life insurance coverage is an economical and uncomplicated option for many individuals. You pay costs every month and the coverage lasts for the term size, which can be 10, 15, 20, 25 or three decades. Level benefit term life insurance. What happens to your premium as you age depends on the kind of term life insurance policy protection you purchase.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. life insurance for business owners through brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

How Does Level Premium Term Life Insurance Keep You Protected?

As long as you remain to pay your insurance coverage costs each month, you'll pay the very same price throughout the entire term length which, for several term plans, is generally 10, 15, 20, 25 or thirty years. When the term ends, you can either pick to finish your life insurance policy coverage or renew your life insurance policy plan, normally at a greater price.

A 35-year-old female in excellent wellness can purchase a 30-year, $500,000 Place Term policy, issued by MassMutual starting at $29.15 per month. Over the following 30 years, while the policy is in location, the expense of the insurance coverage will not change over the term period - Level term life insurance definition. Let's face it, many of us do not like for our costs to grow with time

Your level term price is figured out by a number of factors, the majority of which are connected to your age and health and wellness. Various other aspects include your particular term plan, insurance coverage supplier, benefit quantity or payout. During the life insurance coverage application process, you'll respond to concerns concerning your health and wellness history, consisting of any type of pre-existing problems like an essential illness.

Latest Posts

Final Expense Over The Phone

Funeral Insurance Us

Life Insurance Policy To Pay For Funeral